Regulation

Carbon capture, utilization, and storage (CCUS) policy is taking a prominent position in the climate management debate that is occurring at national, regional, and local levels, and the legal framework for the geologic storage of CO2 continues to evolve. Because of the evolving nature of regulatory frameworks at various levels of government, regulatory information on this site will be updated as often as possible.

Incentive Programs

In addition to federal tax incentives like 45Q, states have taken the initiative to incentivize CCUS projects. For example, North Dakota reduces the coal conversion tax when CO2 is captured, Wyoming has established tax incentives to spur CO2 utilization, and Montana offers a reduced market value property tax rate for carbon sequestration equipment.

Permitting

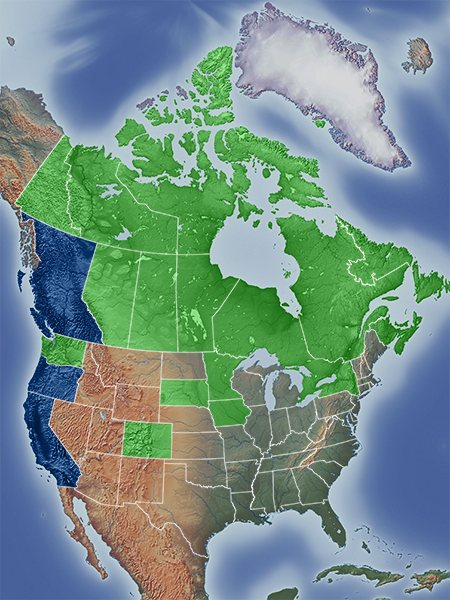

Permitting considerations for a CO2 storage project are important even at the earliest stages of project development. Data and information about project feasibility and geologic suitability of potential storage site(s) will eventually be used to support the permits needed to store CO2. Templates developed by the PCOR Partnership and the EERC are available for better understanding of permitting requirements in the PCOR region.

Core Analysis

Sampling/Testing

Seismic

No. of Injection Wells

No. of Monitoring Wells

Install Infrastructure

Update Permits

Area of Review (legacy wells)

Financial Assurance

Unitization and Project Exhibits

Qualify Site/Project

Design Specifications

FEED

No-Go

No-Go

No-Go